Context

I’ve been listening to K-pop (or Korean pop) as early as the year 2010. While I think I’m very well-informed about the K-pop community, there are still many things I don't know. This project explores the K-pop industry by analyzing and visualizing publicly available data1 to answer these following questions:

- How many entertainment companies are there?

- How many boy groups and girl groups are there?

- Between boy groups and girl groups, which group type is generally more stable?

- What is the median age of idols when they debuted?

- Aside from South Korea, which other countries do idols come from?

Some notes

- You can interact with these graphs by hovering and clicking directly on the graph or on the legends.

- Due to the lack of data on co-ed groups and solo idols (4 co-ed groups and 15 solo idols), I decided to drop it from the analysis.

- The data is from 1995 to August 2022. The database will likely not have all the K-pop groups, so the analysis and conclusions will be made based on the data I have.

- Since these are interactive graphs, it is better to use a laptop to have better experience!

- The full code of analysis can be found on my Github.

The Industry

K-pop has been on the rise to explosive popularity in recent years. In 2021, K-pop album sales saw a 31% increase2 compared to 2020. A research3 by Li contributed the success to 4 aspects: 1) companies seizing the opportunity of the era of accessible media, 2) Korean government has policy to support and encourage the industry, 3) growing of their strength, and 4) deep meaning, touching storyline conveyed by the songs.

To catch on this lucrative business, a total of 256 companies that have been established. Out of that, 194 companies have produced at least 1 group, which means only 62 companies (24.22% of the industry) has enough funding to produce more than 2 groups.

Top 11 companies have produced and managed at least 5 groups. SM Entertainment produces the most groups (16 groups!), followed by JYP and FNC Entertainment (13 and 8 groups, respectively).

Producing idols can be expensive, and considered as a “high risk” endeavor because it can cost about 2 billion won (approximately $1.8 million). Paying for trainees during their training period costs about 30 million won (approximately $27,000) per month4.

For a company to survive, the groups they make have to bring in profit. In an episode of a TV reality show, Key from SHINee joked how his fellow label mates, EXO, built the building they were sitting in from the song “Growl,” BoA built the building at 521 Apgujeong-dong, and his group song’s “Ring Ding Dong” built 4 elevators5 (note that he just mentioned one song per group. EXO, BoA, and SHINee are all popular groups; thus, they bring in more money per comeback for the company).

With 256 K-Pop entertainment companies, they have produced a total of 394 K-pop groups. Interestingly, there is a great dip from 2012-2013 and 2020-2021, and a significant increase from 2016-2017.

You can look closely which groups debuted which year in this graph below.

“The average number of groups preparing to debut per year is 300. Only about 50 of these actually debut, and typically only one or two gain serious recognition in their first year.” (source: Soompi)

Many sources from the K-pop industry say that there are only two ways for guaranteed success for a newly debuted group: 1) They have to be from the three major agencies (SM, YG, and JYP Entertainment); 2) They need the help from a survival program like “Produce 101.” Without one of the two conditions, many groups will disappear from the scene after 2-3 years6.

The Groups

A breakdown of boy vs girl groups produced by companies is in the graph below. From this graph, we can see that the aforementioned top 11 companies generally produce more boy groups than girl groups (the bigger rectangles, the more groups that companies have).

Why is that?

Due to the low likelihood of a group becoming big, K-pop entertainment companies and record labels believed that boy groups are more successful than girl groups because they attract more loyal female followers7 whom are eager to pay for concert tickets and album. In this video essay8, Mina Le discussed about the history and culture significance of boy bands, and why boy bands become popular to the female population, particularly the adolescent and teenager demographic. For young girls, teen idol sensation provides them to explore their sexuality and desires.

On the other hand, according to critic Park Soo-jin9, the K-Pop scene was filled with male musicians in the beginning, such as Seo Taiji, while female singers were shamed for doing something artistic. Hence, the main consumers of the music have been young girls, and the industry has evolved to appeal to their taste, such as customized merchandise and concerts. “This is why the number of female fans willing to spend on stars is greater than that of male fans,” said Park.

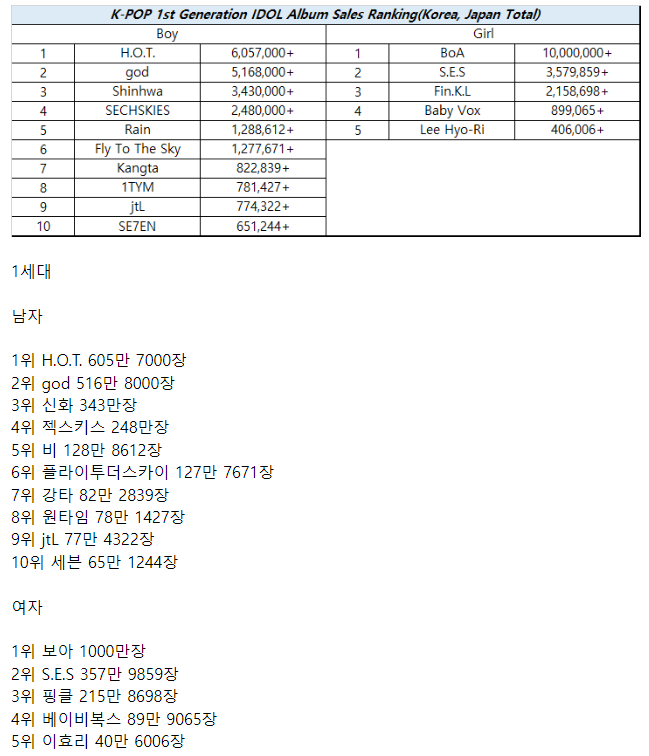

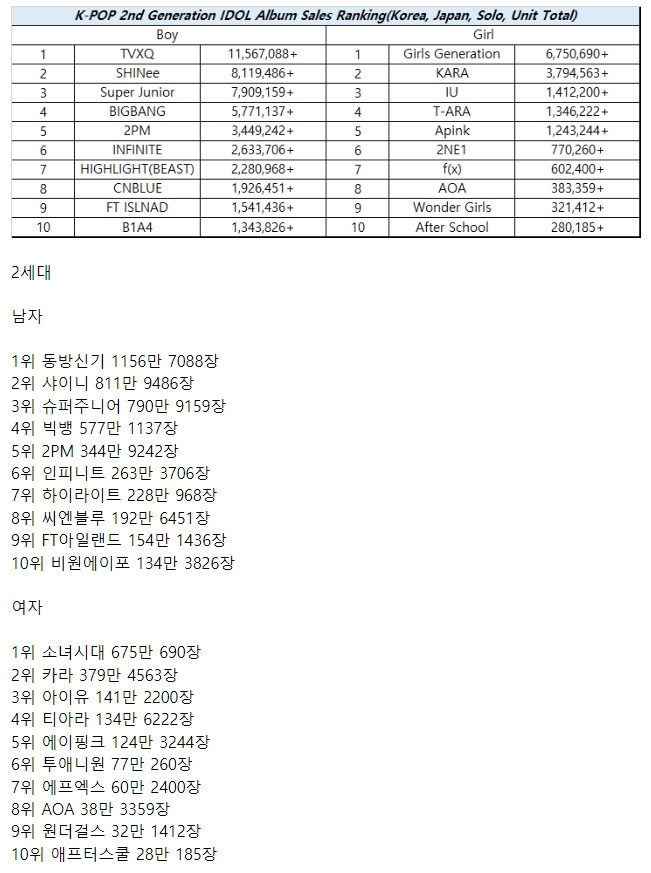

A post on Pann shows the album sales between the boy vs girl groups, except for BoA outselling most boy groups in the 1st generation table, boy groups sold more albums in other generations compared to girl groups (see images below).

For clarification, generations mean the different time period of K-pop. The 1st Generation started in the early 1990s to the early 2000s. The 2nd Generations started in 2003, and said to end somewhere between 2009 to 2010. The 3rd Generation started in 2011 and ended in early or end of 201810.

Some Reddit users discussed why girl groups sell less physical albums than boy groups in a Reddit thread11:

“Girl groups do better with general public, who are more likely to stream music rather than to buy albums. Boy groups rely on loyal fanbase, those who are willing to pay for albums, for success.” — by nctzenhours

Every year, Gaon Chart revealed the ranking of digital and album sales. In 202112, top 10 groups with highest album sales are all boy groups (ex: BTS, NCT 127, NCT Dream, etc.). Compared to the digital sales, however, the top 10 are more diverse with a combination of solo artists, girl groups, and boy groups.

If you want to see the digital and album sales for the first half of 2022, you can look around on this website.

The graph below breaks down the percentage of debut groups by gender over the years. The database did not have any information on groups that debuted on 2000 and 2002; hence, the empty columns. Before 2005, the market was still predominant with boy groups. After 2005, there have been more girl groups debuting, especially in 2009 and 2019 where they have more girl groups debuting than boy groups.

There are marginally more girl groups than boy groups, but less female idols than male idols.

This is because boy groups are generally larger than girl groups; hence, there are more male idols than female idols. The median number for girl groups is 5 members, while for boy groups is 6 members. Additionally, boy groups seem to have more outliers, for example, NCT with 23 members (and still counting)!

In fact, girl groups have more lineup changed, and are more likely to be inactive compared to boy groups.

Girl groups are more likely to have members added or left the groups compared to their boy groups counterpart. Particularly, they are more likely to have more members compared to when they debuted.

The graph below breaks down the group status (active/inactive/on hiatus) and member consistency (added/subtracted/same number of members) for boy vs girl bands. Click on it to learn more!

Becoming inactive or disbanding happens due to the exclusive 5-to-10-year “slave contracts” that idols often sign with record labels, where they are tied into “long exclusive deals, with little control or financial reward13.” Hence, often times, idols chose not to re-sign with their representative company, or sometimes, file a lawsuit against their agency. For example, TVXQ filed a lawsuit against SM Entertainment in 2010 over “contract length” and “unfair profit distribution14.”

On the other hand, companies chose not to re-sign with a group if that group stopped being profitable (a lot of ethical problems to unpack here). For example, 4Minute’s disbandment was due to Cube Entertainment (their agency at the time), believed that the group was “unprofitable15.”

Among active groups, only 41% of girl groups are active, while 58% of boy groups are active. Additionally, 67% are girl groups are inactive, while only 33% of boy groups are inactive (see graph below).

While this confirms what is discussed above, it is sad to see how much of a disadvantage position girl groups have compared to boy groups, in terms of sales. Especially, if they come from a small company, they would struggle even more.

This is unfortunate, because the first K-Pop groups to perform overseas are girl groups16. Groups like Wonder Girls, KARA, or Girl’s Generation were the first to appear in international charts, such as the Billboard Hot 100 chart or the Oricon, back in the early 2010s.

In 2008, Wonder Girls’ hit song “Nobody (English version)” made it to No. 76 on Billboard Hot 10017. The song served as a model for other Korean artists to use as ways to successfully enter the U.S. market, which involved adapting the viral-ready K-pop sound to the American audience, just like how they do to enter the Japanese and Chinese markets. For the past decades, releasing English-language versions of their top songs has been the case for various bands. With K-pop is becoming more global, and the American music charts are becoming more open to other langauges, BTS and BlackPink have shown that singing in English is not a requirement for K-pop groups anymore. However, it is still a common practice for many groups18.

The Idols

As K-pop is becoming more global, there are more idols who aren't South Korean. Companies do this to catch the attention of the people from the country that these idols were born in; thus, expanding their international sales with foreign fans. In total, there are more idols from Japan (57 idols) and China (45 idols) than in any other country. This is because Japan19 and China bring in much more profit20 than other countries.

The graph below shows the changes in demographic of idols' nationality who aren't South Koreans. As K-pop expands, there are more people from different countries who move to South Korea to become idols.

As K-pop becomes more international, so is the music they create to target the general public. The 4th generation bands have quickly adopted more contemporary musical genres, such as disco, rap, hip-hop, and even hyperpop into their catalog21. The fourth-generation groups stand out because they are more adaptable and open to incorporating Western influences.

A Korean media outlet, Hankook Ilbo22, discussed further the popularity between girl vs boy groups in the 4th generation. They believed that the current girl groups’ popularity is higher than that of boy groups. The outlet referenced that most of the 2022 hits are released by girl groups, such as aespa's "Next Level," IVE's "LOVE DIVE," "STAYC's "STEREOTYPE," and more.

The article emphasized that their target markets were the primary cause of the fundamental difference in their levels of popularity. While male groups cater to their fanbase, female groups target the public.

Securing their impact on the general K-pop fans outside their fandom is more significant. This explains why the members and their songs are also popular even among non-K-pop fans and mainstream fans (source: kpopstarz).

Some K-pop supporters believed that 2022 was the year for girl groups. First was because of the quantity of comebacks from the “powerhouses” such as BlackPink, SNSD, or Twice, as well as well-received debut songs from rookies groups such as NewJeans or LE SSERAFIM23.

Aside from the quantity of comebacks and debuts, girl bands also release high-quality music that the public audience like; thus, resulting in high sale figures in the past 8 months24.

The Controversies

While the industry is getting bigger and more global, it also receives various criticism regarding corruption25, exploitation26, sexualization27 28 (especially of minors29), and mental health30. An article from Cosmopolitan discussed these topics in-depth.

Minors’ participation in the industry, working and getting exploited by the companies have been a concerning and heated topic for years. The graph below shows the rough debut age of idols.

Roughly, female idols’ median debut age falls in between 18-20 years old; while male idols’ median debut age is 19. There are more female idols who debuted before they turned 18 years old as compared to their male counterparts, while, there are more male idols debuted after 20 years old than their female counterparts. In fact, there aren’t that many female idols who debuted after 23 years old.

Result summary

| Questions | Answers |

|---|---|

| How many entertainment companies are there? | There are a lot of entertainment companies in the span of 27 years. Most of them have produced at least 1 group. The top 11 companies produced at least 5 groups. SM Entertainment produces the most groups in this time frame. |

| How many boy groups and girl groups are there? | The differences in number of girl vs boy group is minimal. Girl groups take up 51% of the industry, while boy groups take up about 49%. However, there are more male idols than female idols, because there are more members in boy groups compared to girl groups. |

| Between boy groups and girl groups, which group type is generally more stable? | Girl groups have more struggles in the industry compared to boy groups. They are more likely to be inactive, have changes in members than their boy group counterpart. |

| What is the median age of idols when they debuted? | The rough median debut age for female idols are between 18-20; while for male idols are 19. There are roughly more female idols debuted before they turned 18 years old; while there are more male idols debuted after 20 years old. |

| Aside from South Korea, which other countries do idols come from? | Most idols come from Japan and China, as both countries bring in the most profit for the companies as compared to other countries. |

Conclusion

K-pop is a lucrative but harsh business. The number of female to male idols are almost the same, albeit there are more incentive for boy bands then there are for girl bands. On top of the sexualization and exploitation practices behind the scene, debuting minors is a heated topic among the K-pop fans. More female idols debuted at much younger ages than male idols, and very few female idols debuted after the age of 23. As K-pop expands, companies have more idols who aren't South Koreans to appeal to the international market, particularly from Japan and China.